Tokenized Invoice Factoring: Supply Chain Finance on Autopilot

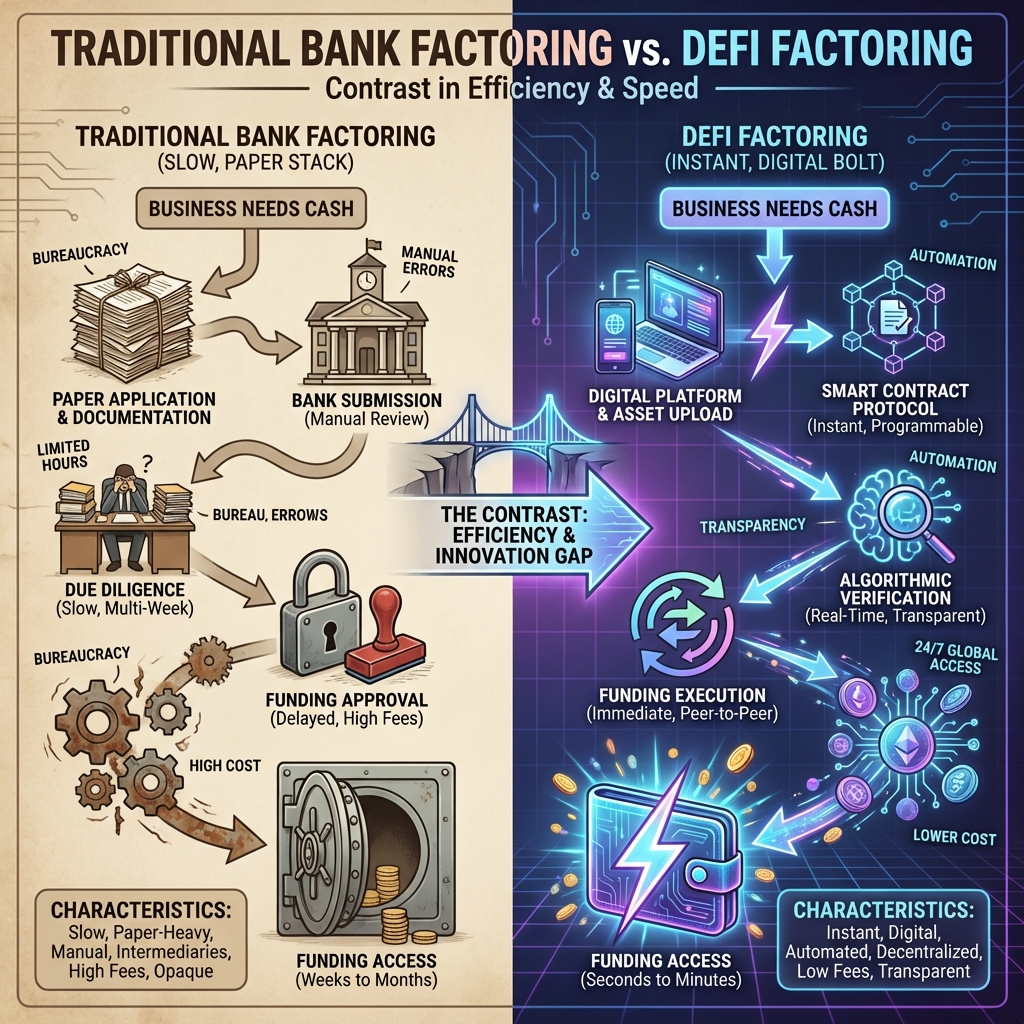

Executive Summary: The "Trade Finance Gap"—the money businesses need to operate vs. what banks will lend them—hit $2.5 Trillion in 2025. In 2026, DeFi protocols have stepped in. By turning unpaid invoices into liquid NFTs, suppliers can get paid instantly by a global liquidity pool, bypassing clunky banking factoring.

Introduction

"Net 90 Terms." Two words that kill small businesses. You deliver the goods today, but the retailer pays you in 3 months. In the meantime, how do you pay your staff? Traditionally, you go to a bank for "Factoring." They buy your invoice at a 5% discount but take weeks to approve you. In 2026, you mint the invoice as an NFT. You list it on Centrifuge. A DAO in London buys it instantly. You get cash in 9 seconds.

The Technology: RWA NFTs

An invoice is just a promise to pay.

- Origination: A supplier uploads their invoice (PDF/XML) to the protocol.

- Verification: An Oracle (like Chainlink) checks the buyer's credit score and verifies delivery via logistics API (FedEx/Maersk).

- Tokenization: The invoice becomes a unique NFT.

- Funding: Liquidity providers (holding USDC) buy the NFT at a discount (e.g., $98 for a $100 invoice).

- Repayment: When the retailer pays the invoice 90 days later, the funds go to the smart contract, which repays the investors.

Key Players

1. Centrifuge

The market leader. They connect operational assets (invoices) to DeFi liquidity (MakerDAO, Aave). Their asset originators have funded over $10 Billion in trade finance.

2. Defactor

Focuses on emerging markets. They finance everything from whiskey barrels in Scotland to electronics shipments in India. Their "DeFi-first" risk scoring allows them to fund businesses that banks ignore.

3. Polytrade

Specializes in cross-border trade. They handle the FX conversion automatically, so a supplier in Vietnam can be paid in VND while the lender in the UK lends in GBP, with the protocol swapping via stablecoins in the middle.

Why Investors Love It

Crypto yields are volatile. Invoice yields are stable (10-12% APY).

- Short Duration: Most invoices mature in 30-90 days. Your money isn't locked away for years.

- Uncorrelated: People pay their bills regardless of whether Bitcoin is up or down.

- Recourse: If the buyer defaults, the NFT legally represents a claim in court.

FAQ

Q: What prevents fake invoices? A: Did (Decentralized Identity). Both the supplier and the buyer must have verified on-chain identities. The buyer must "sign" the invoice on-chain to acknowledge the debt before it can be funded.

Q: Is this only for big companies? A: No. It democratization finance. A freelancer owed $500 can tokenize that invoice just as easily as a factory owed $500,000.

Q: What happens if the retailer goes bankrupt? A: That is the risk. Investors take the "Credit Risk" of the buyer. That's why the yield is 10%, not 4%. Protocol "Junior Tranches" absorb the first losses to protect senior investors.

Q: How does this impact supply chains? A: It makes them resilient. If suppliers have cash, they don't go bust during downturns, ensuring the goods keep moving.

Conclusion

Tokenized Factoring brings Wall Street efficiency to Main Street commerce. It turns the "I.O.U." economy into a liquid market, ensuring that productivity is never stalled by a lack of cash.

اپنے علم کو کام میں لانے کے لیے تیار ہیں؟

آج ہی AI سے چلنے والے اعتماد کے ساتھ ٹریڈنگ شروع کریں

شروع کریںمتعلقہ مضامین

Stablecoins: The New Global Settlement Rails

SWIFT is too slow. Visa is too expensive. In 2026, Stablecoins settle $50 Trillion annually, becoming the default layer for cross-border B2B payments.

BNPL 2.0: The B2B Credit Revolution

Buy Now Pay Later isn't just for sneakers anymore. In 2026, B2B BNPL allows companies to finance cloud costs, inventory, and SaaS subscriptions on-chain.

Tokenized Mortgages 2026: Home Ownership on the Blockchain

The 30-day closing period is history. Tokenized mortgages allow for instant settlement, fractional ownership, and global liquidity for real estate debt.